how to file back taxes yourself

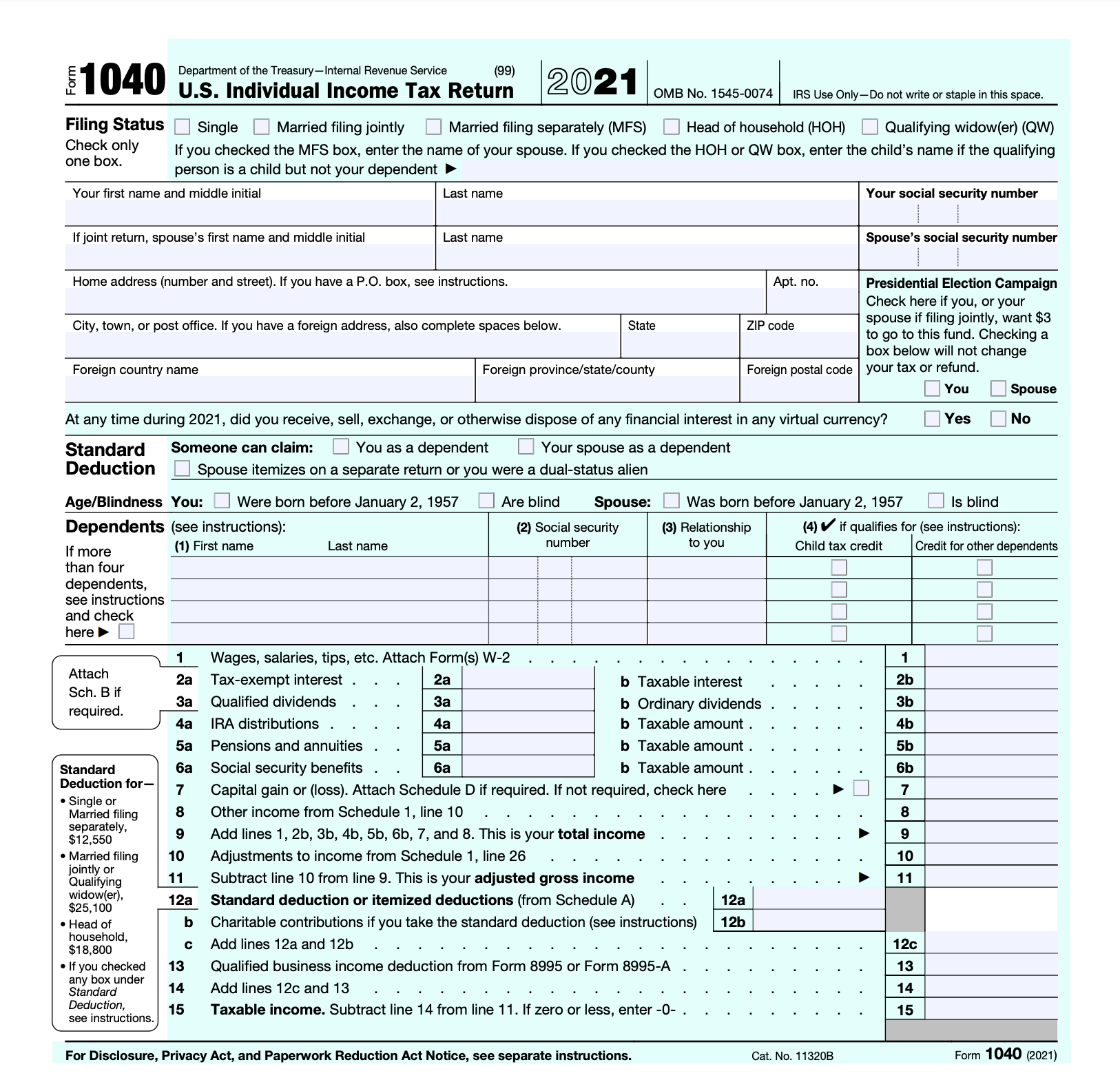

By April 15 each year you must file State and federal income tax returns which will tell you if you still owe more income taxes or if you paid too much for the year. Determine how youll file your back taxes.

It S Been A Few Years Since I Filed A Tax Return Should I Start Filing Again H R Block

To file back taxes start by determining which years you need to file and locating the W-2s 1099s or 1098s associated with those years.

. Back tax returns must be filed on paper and mailed to the IRSthey cant be filed electronically. 3 Should you file your tax returns if you cant pay the taxes. You can also call the IRS but the wait.

How to File a Divorce in Montana. Form 8962 Premium Tax Credit. Get our online tax forms and instructions to file your past due return or order them by calling 800-TAX-FORM 800-829-3676 or 800-829-4059 for TTYTDD.

How to File Back Taxes The hard part about filing back taxes is tracking down the relevant paperwork. To file back taxes youll need to purchase the edition of HR Blocks software for the year or years that you need to file. Contact the IRS for Tax Filing Questions.

Next you can manually complete the. You can file back tax returns by mail simply by printing off the forms from the IRS website and mailing them in using standard USPS mail services or you can use a service provider who can. You still may have to use a tax software program or tax professional to e-file old tax returns.

You may be able to use tax software to prepare your returns but youll have to. When self-preparing your taxes and filing electronically you must sign and validate your electronic tax return. 4 Step 1 Get your wage and income transcripts from the IRS 41 Online 42 Mail 5 Step 2 Prepare and file your tax returns 6 Step.

The IRS may file a return for you. Request a Drop-off folder and client data sheet from a Tax Pro at a Jackson Hewitt location. To e-file back taxes with HR Block you can purchase HR Block.

If you live in Montana and need to file for dissolution of marriage divorce youll need to know about the law and procedures. How to File Back Taxes. Dont forget your state return.

Try FTB and IRS efile and. Youll need to have handy your Social Security number or individual taxpayer. Get relief from the IRS.

For the fastest information the IRS recommends finding answers to your questions online. Comb through your files request your old W-2s from your employer or. For personal returns you will need any and all T-slips such as T4s and T5s.

If you are missing any slips or are unsure if you have them all you. Another way to file your old taxes involves going to the local IRS office. Insert completed data sheet and all relevant tax documents into the folder and directly hand to.

If you want to find out the status of your past-due tax return you can call the IRS at 800-829-1040. Be prepared to pay fees or penalties. Filing back taxes is something you can do on your own but if you have a more complicated return you may want to enlist the help of a tax professional.

Tax Preparation For Beginners The Easy Way To Prepare Reduce And File Taxes Yourself Instafo Cohen George 9798715436825 Amazon Com Books

Free Tax Filing See If You Qualify Turbotax Free Edition

Guide To Filing Business Taxes

How To File And Pay Small Business Taxes Bench Accounting

How To File Back Taxes 14 Steps With Pictures Wikihow Life

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

Guide To Filing Your Taxes In 2022 Consumer Financial Protection Bureau

The Best Online Tax Filing Software For 2022 Reviews By Wirecutter

How Many Months Do You Have To Work To File Taxes

How Do I File Returns For Back Taxes Turbotax Tax Tips Videos

Filing A Tax Return For A Family Member Or Someone Other Than Yourself The Official Blog Of Taxslayer

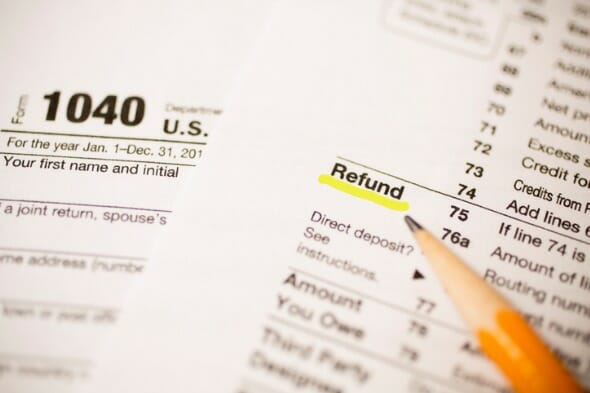

How Long Does It Take To Get A Tax Refund Smartasset

Delinquent Or Unfiled Tax Return Consequences For Irs Taxes

Filing Taxes For A Small Business With No Income What You Should Know Legalzoom

If My Husband Owes Back Taxes How Do I File

Credit Karma Tax Vs Turbotax Which Is Better For Filing Taxes