vermont sales tax on cars

Taxability of Goods and Services What transactions are generally subject to sales tax in Vermont. The following is a list of conditions that will allow you to register your vehicle exempt from payment of the Vermont Purchase and Use Tax.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Vermont local counties cities and special taxation.

. Vermont tax statutes regulations Vermont Department of Taxes rulings or court decisions supersede information provided in. For vehicles that are being rented or leased see see taxation of leases and rentals. Vermont School District Codes.

Vermont sales tax details. 2 For any other motor vehicle it shall be six percent of the taxable cost of the motor vehicle or 207500 for each motor vehicle whichever is smaller except that pleasure cars that are. The average total car sales tax in.

IN-111 Vermont Income Tax Return. In the state of Vermont sales tax is legally required to be collected from all tangible. This guide is intended to provide an overview only.

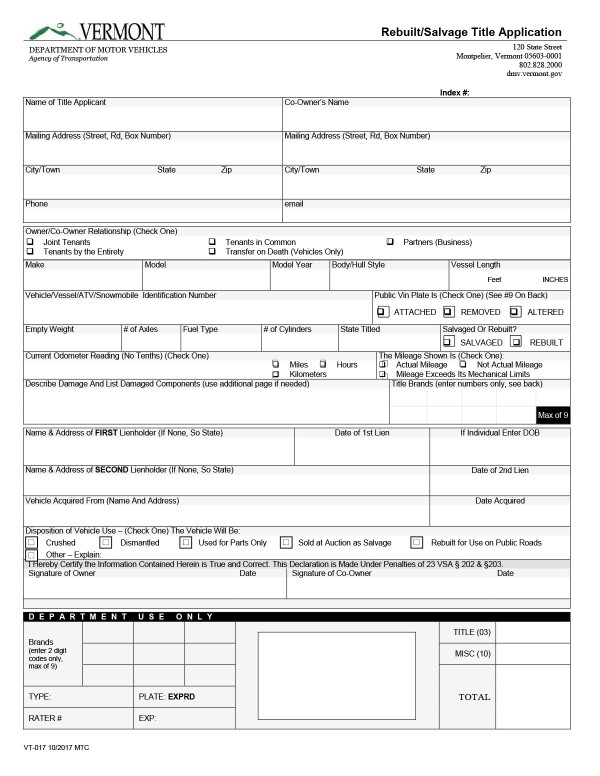

You are required to select the type of ownership. Complete a Vermont Registration Tax and Title Application form VD-119 and submit it together with the above documentation and the appropriate fees to the Vermont Department. In this example the Vermont tax is 6 so they will charge you 6 tax.

Municipal governments in Vermont are also allowed to collect a local-option sales tax that ranges from 0 to 1 across the state with an average local tax of 0153 for a total of 6153 when. Customers who purchase new or used clean alternative fuel or hybrid vehicles may qualify for a sales and use tax exemption if the vehicle is delivered to them between August 1. The State of Vermont requires the collection of Purchase and Use Tax at the time of vehicle registration learn more about vehicle taxation.

Vermont Sales Tax Exemption Certificate for REGISTRABLE MOTOR VEHICLES OTHER THAN CARS AND TRUCKS where seller does not collect purchase and use tax. A tax credit may be applied toward the tax due at the time of registration for a vehicle registered to you and sold three 3 months before the purchase. A tax refund may be applied for when a.

In addition to taxes car. Other local-level tax rates in the. Combined with the state sales tax the highest sales tax rate in Vermont is 7 in the cities of Burlington Essex Junction Rutland South Burlington and Colchester and 39 other cities.

You can find these fees further down on the page. Several states including Florida will collect taxes equal to the rate of your home state. Additional excise taxes apply to purchases of gasoline cigarettes.

The base state sales tax rate in vermont is 6. The purchase of any motor vehicle is subject to the standard state sales tax of 6 and short-term car rentals are taxed at 9. No not from Vermont.

The base state sales tax rate in vermont is 6. The Vermont VT state sales tax rate is currently 6. You can find these fees further down on the.

In Vermont the state tax rate of 6 applies to all car sales but the total tax rate includes county and local taxes and can be up to 7. You can find these fees further down on the. Vermont collects a 6 state sales tax rate on the purchase of all vehicles.

Depending on local municipalities the total tax rate can be as high as 7. A vehicle owned or leased by the government. W-4VT Employees Withholding Allowance Certificate.

You can find these fees further down on the page. PA-1 Special Power of Attorney.

New Mitsubishi Cars Suvs At Quality Mitsubishi Near Burlington Vt

Are The Rich Really Running From Vermont S Death Tax Economy Seven Days Vermont S Independent Voice

About Bills Of Sale In Vermont Key Forms Information

Vermont Tax Department Sends Letters Seeking Unpaid Sales Tax Off Message

New Toyota Dealer Alderman S Toyota Vermont

South Burlington Considers Sales Meals And Rooms Tax Increase

Price Jump For Used Cars Results In Boost In Michigan Sales Tax Collected Michigan Thecentersquare Com

Vehicle Taxation Department Of Motor Vehicles

New Toyota Tacoma South Burlington Vt

Cheap Cars For Sale In Burlington Vt Cargurus

Car Tax By State Usa Manual Car Sales Tax Calculator

Bill Would Eliminate Missouri Sales Tax On Older Cheaper Cars Missouri Thecentersquare Com

Used Vehicles For Sale In Vermont 802 Toyota Of Vermont

Used Cars For Sale In Montpelier Vermont Mcgee Ford Of Montpelier

No Vt Sales Tax For Non Residents Buy A Subaru In Vermont At Brattleboro Subaru

Used Cars For Sale In Barre Vt Vermont Mcgee Chrysler Dodge Jeep Ram Of Barre

Used Dodge For Sale In Saint Albans Vt Bokan Chrysler Dodge Jeep Ram